NYC Inks Medicare Advantage Deal; Aims to Cut Off Traditional Medicare for Retirees

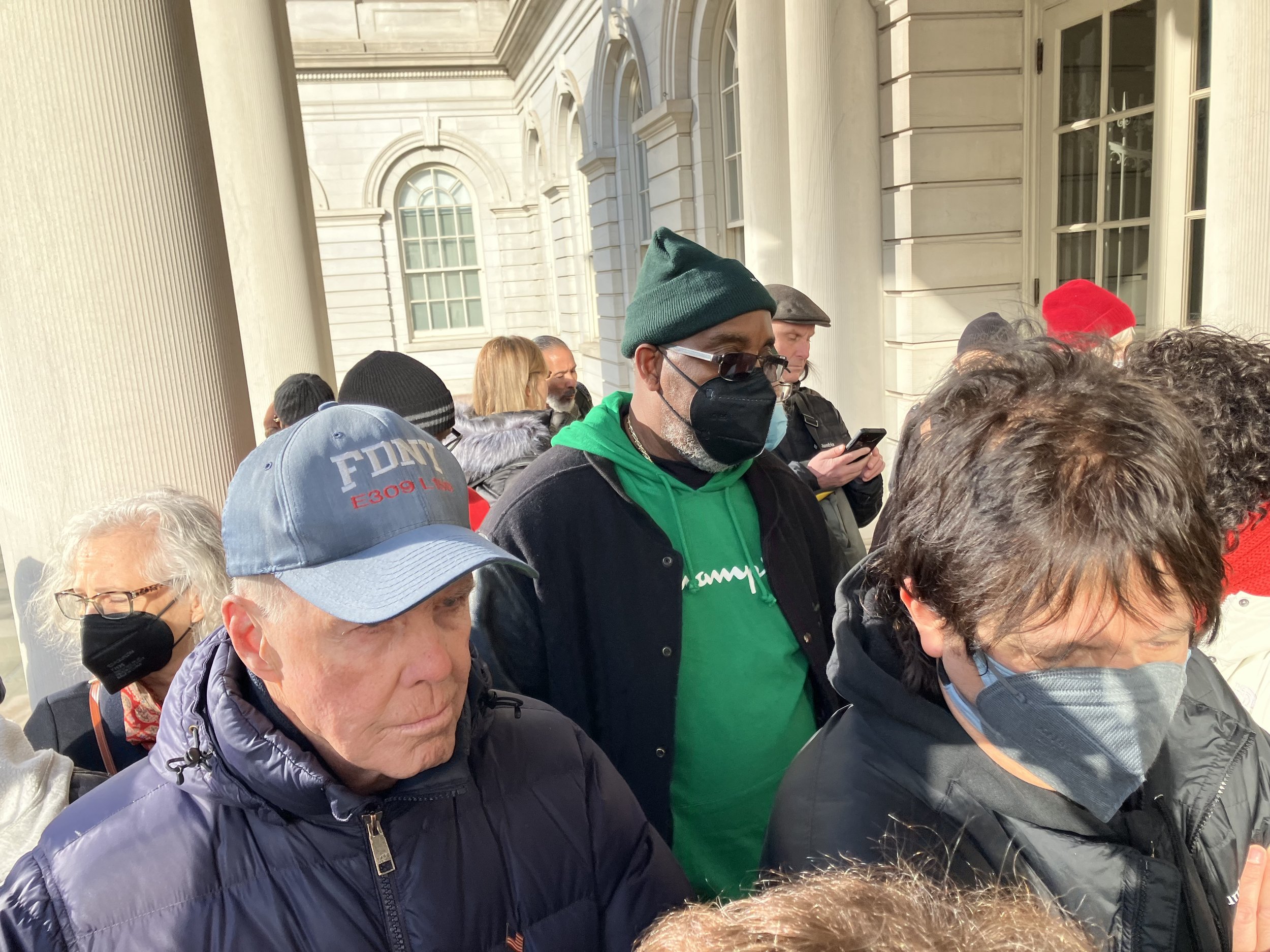

New York City municipal retirees line up outside City Hall on Jan. 9 hoping to get into a hearing on efforts to strip them of their traditional Medicare coverage. Photo by Joe Maniscalco

By Steve Wishnia

New York City has signed a contract with the Aetna insurance company to provide a private Medicare Advantage health-insurance plan to the about 250,000 retired municipal workers. The deal, announced Mar. 30 by Mayor Eric Adams and Office of Labor Relations Commissioner Renee Campion, means retirees will no longer be able to use traditional Medicare unless they pay for coverage themselves.

Retiree groups that have opposed privatization reacted angrily. “I'm mad as hell! I'm appalled at how little regard this mayor has for New York City elders’ health and financial well-being,” Sarah Shapiro of the Cross-Union Retirees Organizing Committee told Work-Bites. “This is how he treats retirees? We, in CROC, are in our 60s, 70s, 80s, and 90s, and we say, ‘Hell no! We will not stop fighting for what we worked for, what we earned and what we deserve!’”

Marianne Pizzitola, president of the New York City Organization of Public Service Retirees, called the deal “a betrayal of the City’s moral and legal obligation to its dedicated civil servants.”

“The only option now on the table puts decisions about retirees’ health in the hands of an insurance company, not our doctors,” she said in a statement. “Now, retired firefighters, police, EMT workers, and teachers will be forced into a privatized, managed-care plan that has strict in-network, pre-authorization, and referral requirements that will cause potentially life-threatening delays and denials of care.”

The mayor’s office said the Aetna Medicare Advantage plan would have a lower deductible for retirees than their current Senior Care plan, a supplement that covers the 20% of costs that Medicare doesn’t pay. The Medicare Advantage plan, it added, also places a cap on out-of-pocket expenses, offers “wellness incentives,” and “significantly limits the number of procedures requiring prior authorization.”

All retirees currently enrolled in Senior Care will be automatically moved to the Medicare Advantage plan on Sept. 1. The only exception is if they opt out and enroll in the city’s HIP VIP health-maintenance organization plan instead, which is available to people who live in the city, Long Island, and Westchester, Rockland, or Orange counties.

The administration rejected a proposal to preserve premium-free Medicare known as “Option C.” In it, the city would have continued paying the full cost of retirees’ current plans if they decided to keep them.

Commissioner Campion, in a Daily News op-ed article Mar. 30, said that option “would eliminate almost all the potential savings from Medicare Advantage and undermine the city’s ability to continue providing high-quality, premium-free care to active employees and retirees.”

It would have cost the city about $200 per person per month, plus a $20-a-month fee to Aetna for each person who opted for Medicare Advantage, she wrote.

Campion said the deal will save the city $600 million a year in health-insurance costs — the amount the major municipal employee unions agreed to in 2018 — because the federal government will pay Aetna, and the city will no longer pay for Senior Care.

She wrote that “96% of our retirees’ doctors already accept the Aetna Medicare Advantage plan,” and that the city had responded to retirees’ concerns about prior authorization “by eliminating it for around 80% of procedures, including MRIs, PET scans, and CAT scans.”

Privatization’s dubious economics

“We are faced with paying for our own supplemental Medicare and losing our reimbursements,” Stu Eber of the Council of Municipal Retiree Organizations said in a message to Work-Bites, “or being in a plan not accepted by many of our providers and hospitals. This is an unacceptable choice for elderly people in nursing homes, assisted living and cancer treatment programs. It is unacceptable for tens of thousands of retirees with pensions, and Social Security payments that are at the poverty level or lower.”

The idea that the city can both save money by privatizing health coverage and provide excellent health care is “an absolute lie,” responds Len Rodberg, a retired professor of urban studies at Queens College and a member of the Professional Staff Congress and CROC.

The city will no longer be paying for retirees’ supplemental Medicare coverage, he explains, but those savings would be reduced if it’s paying Aetna in exchange for reducing the number of prior authorizations. Whatever savings it achieves, he adds, will come at a cost to retirees’ care.

“They haven’t changed the basic economics,” Rodberg says. “From the patients’ point of view, it’s cut-rate medicine. The perversity of private insurance is that the more care they provide, the less money they make.”

Medicare Advantage plans spend 24% less per person than traditional Medicare does, according to figures from the pro-single-payer group Physicians for a National Health Program, because they have much higher overhead and don’t receive payments for supplemental coverage. The federal subsidy, the amount the government pays per patient above traditional Medicare, is about 4%.

“Medicare Advantage, which was invented as a cost-containment strategy, costs the federal government more than traditional Medicare,” says Barbara Caress, an adjunct professor of health policy at Baruch College and a PSC member. “It’s the most profitable product for insurance companies.”

Its costs rose rapidly after it was introduced in 2003. The federal subsidy quickly surpassed 10%. The Affordable Care Act, enacted in 2010, reduced that to zero, but gave insurers an incentive to enroll sicker patients instead of “cherry-picking” healthier ones who needed less care, Caress explains. It created a “risk adjustment” system that expanded the number of ailments for which the government would pay more.

Insurance companies gamed that, Caress says, by “upcoding” — listing patients as having ailments that qualified for risk adjustment, even if they weren’t being treated for them.

“As long as somebody notes it on your chart, it’s codable,” she says. Early-stage kidney disease, for example, is a keep-an-eye-on-it condition that usually isn’t treated, but once it was added to the risk-adjustment list, “suddenly, there was an epidemic.”

She believes federal payments to Medicare Advantage plans are likely to be reduced soon, as the Biden administration is considering a crackdown on upcoding. That could mean Aetna might come back to the city and say it needs higher copayments or to reduce benefits, to make up for the reduced revenues.

“The City needs to rethink its rush to privatization and continue to provide the free, Medicare-based coverage we were promised,” Eber says. At the Office of Labor Relations’ telephone hearing on March 28, he notes, not one caller spoke in favor of the Medicare Advantage contract.

“We now have a badly divided union movement because the Municipal Labor Committee leadership fell into the trap set by the City Office of Management and Budget,” he says. “We should expect another protracted court battle that will not provide OMB with their $600 million pound of flesh this fiscal year, if ever.”